The launch of spot Bitcoin Exchange-Traded Funds (ETFs) marks a significant milestone in the development of cryptocurrencies. After a long wait and overcoming numerous regulatory hurdles, these ETFs have made a strong entrance onto the financial stage, profoundly impacting the cryptocurrency domain and its surrounding ecosystem. This represents not just a technological innovation but also a critical step towards Bitcoin’s entry into a new mainstream era.

The introduction of these ETFs symbolises the end of the era dominated by complex futures contracts and derivatives. By directly tracking the price of Bitcoin, they offer investors an easy way to invest in digital currency through a reliable, traditional exchange-traded fund mechanism. This opens the door for institutional funds, allowing Bitcoin to be accessible to pension funds, wealth management firms, and ordinary investors.

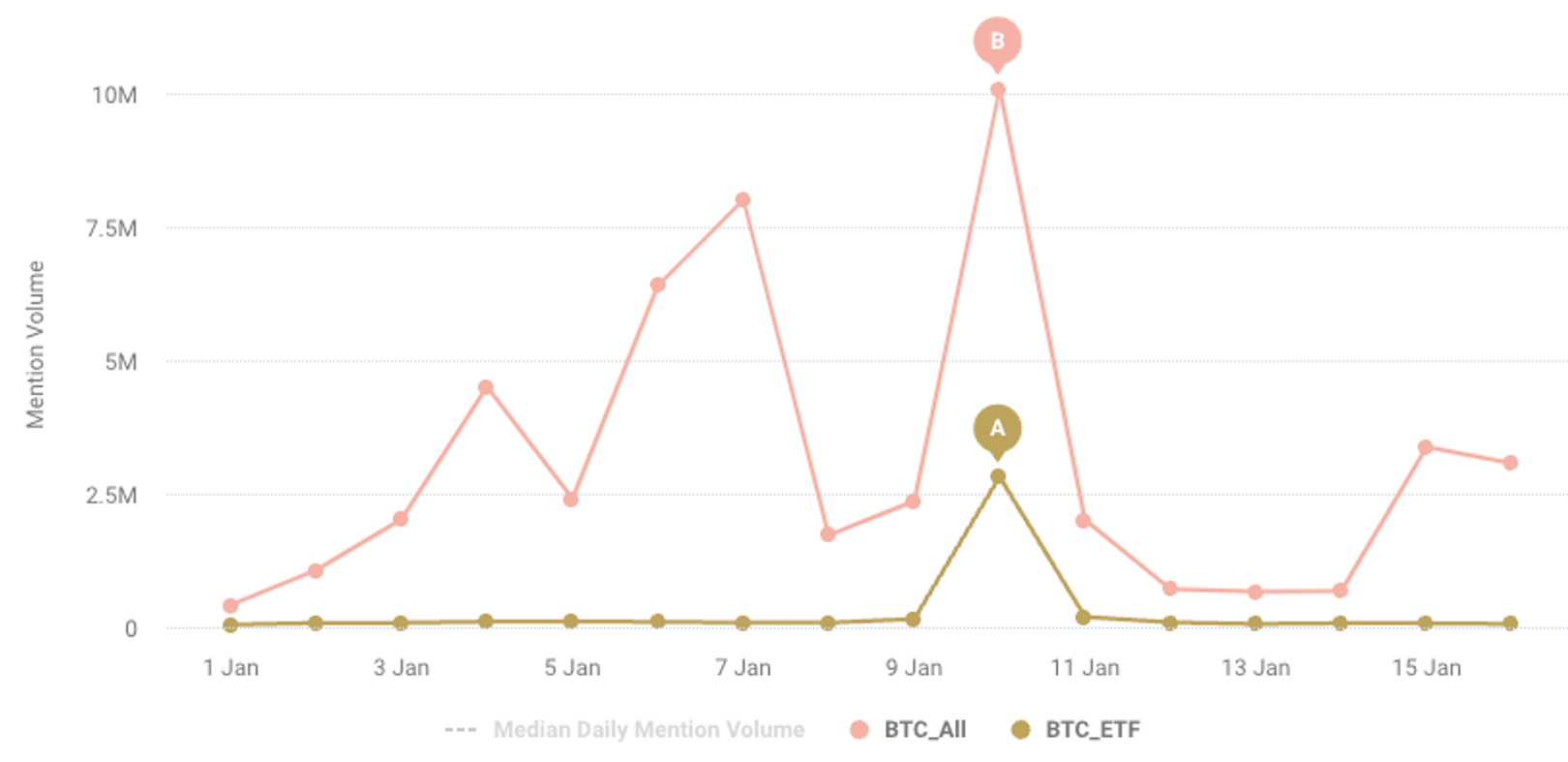

Figure 1:Social media mentions of Bitcoin and its ETFs peaked on January 10|Source: TOCANAN

Data from social media listening shows that in early January, discussions about Bitcoin and Bitcoin ETFs reached 62.62 million posts, with Bitcoin ETFs accounting for 8% of these discussions. Particularly on January 10, discussions peaked, focusing on the anticipation of Bitcoin ETFs receiving SEC approval, market analysis, and the potential impact of a suspected hack on the SEC’s Twitter account. Discussions also touched on the overall development of the cryptocurrency industry, such as the rise of the NFT market, the popularity trend of stablecoins, and general comparisons between Bitcoin and other cryptocurrencies.

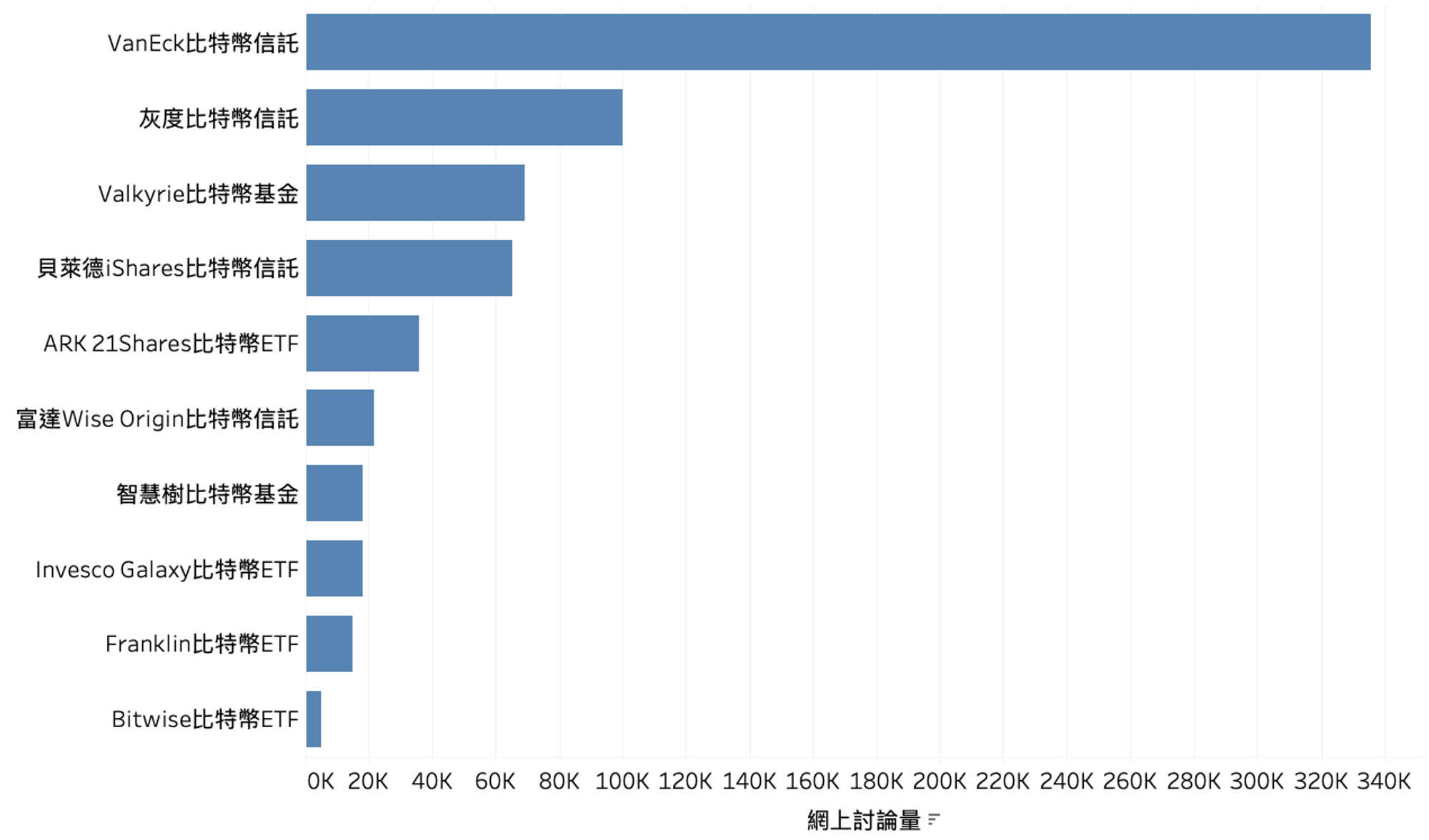

The ETFs receiving approval include VanEck Bitcoin Trust, Grayscale Bitcoin Trust, Valkyrie Bitcoin Fund, BlackRock iShares Bitcoin Trust, ARK 21Shares Bitcoin ETF, Fidelity Wise Origin Bitcoin Trust, WisdomTree Bitcoin Fund, Invesco Galaxy Bitcoin ETF, Franklin Bitcoin ETF, and Bitwise Bitcoin ETF. Their fee structures vary, ranging from 0.2% to 1.5%, with some issuers offering fee discounts to promote their products.

Figure 2:VanEck’s Bitcoin Trust stands out in social media discussions for its long-term holding strategy, garnering intense investor interest|Source: TOCANAN

The trading volume on the first day of issuance, January 12, exceeded $4.6 billion, highlighting the immense interest from investors in this new investment tool. The VanEck Bitcoin Trust was particularly notable in social media discussions for its strategy of actively buying and holding, encouraging investors to stay the course during market volatility for long-term gains.

These ETFs have attracted widespread attention because they bring significant changes to the market. They not only enhance market liquidity and facilitate the buying and selling of Bitcoin but also lower the entry barrier for traditional investors into the cryptocurrency market. The approval by the U.S. Securities and Exchange Commission (SEC) has added legitimacy to Bitcoin, easing concerns about its regulatory environment. These ETFs have built a bridge allowing large financial institutions to include Bitcoin in their investment portfolios.

Despite not everyone being optimistic about the future of Bitcoin and these ETFs, with critics concerned about Bitcoin’s volatility, the possibility of market manipulation, as well as uncertainties in the regulatory environment and potential tax issues, the immense potential and transformative impact of spot Bitcoin ETFs cannot be underestimated.

Bitcoin ETFs have officially opened the doors to Wall Street, representing a development of great interest not only to seasoned cryptocurrency enthusiasts but also to conservative traditional investors. The launch of these Bitcoin ETFs has not only changed the landscape of investment tools; they promise to transform Bitcoin into a new asset class, indicating that it will become an indispensable part of our wealth management, much like index funds.

Book a meeting to let us know how we can help.